Know Your Score, Know Where Your Credit Stands

Your credit score is a crucial part of your financial health. With TransUnion, you can check your credit score and receive daily updates to stay informed. You’ll also gain insights into credit score factors to understand how your financial decisions impact your credit standing.

Take Control of Your Credit Health

Fraud Alerts

A fraud alert notifies creditors to take extra steps to verify your identity before extending credit, adding an extra layer of security to your financial profile.

Credit Freeze & Unfreeze

You can place a free credit freeze to control who has access to your credit information. When you need to apply for credit, simply unfreeze it with ease.

Free Annual Credit Report

Access your free weekly credit report from AnnualCreditReport.com to keep track of your credit health and ensure accuracy.

Credit Dispute

TransUnion allows you to verify the information on your credit report, initiate disputes for inaccurate details, and track the status of your disputes conveniently.

Credit Report Access

You can obtain free weekly credit reports from all three major credit bureaus at AnnualCreditReport.com. Additionally, you can receive your TransUnion credit report via the free TransUnion Service Center or through a paid credit monitoring subscription.

Fraud Protection and Military Support

Fraud Alerts

TransUnion provides different levels of fraud alerts, including 1-year, 7-year, and Active Duty Military alerts, which help prevent unauthorized access to your credit. These alerts can be removed at any time without affecting your credit score.

Active Duty Military Credit Center

Military personnel can take advantage of free credit monitoring services to safeguard their financial health during deployments or frequent relocations.

Understanding Credit Repair

TransUnion helps you dispute inaccuracies on your credit report, build credit confidence, and access tools to maintain a strong financial profile.

Identity Protection

Receive expert tips to safeguard your credit report and manage your personal information, reducing the risk of identity theft.

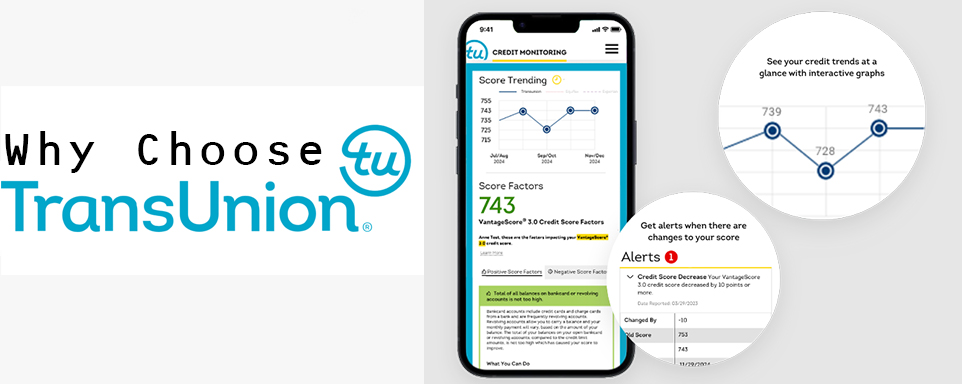

Credit Monitoring Services

Stay updated with TransUnion’s credit monitoring services, which provide real-time alerts for changes to your credit report. Monitoring your credit consistently helps you make informed financial decisions and stay protected against fraudulent activity.

Consumer Support

TransUnion offers self-service options for consumers to manage their credit, ensuring quick and efficient assistance.

Consumer Privacy Rights

TransUnion prioritizes data privacy and offers secure processes for managing personal information. Consumers can control their data and make privacy-related requests in compliance with state laws.

Why Choose TransUnion?

TransUnion’s comprehensive credit management tools empower you to monitor your credit, protect your identity, and maintain financial well-being. With fraud prevention, credit monitoring, and identity protection, you can confidently navigate your financial future.